This sums it up nicely...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

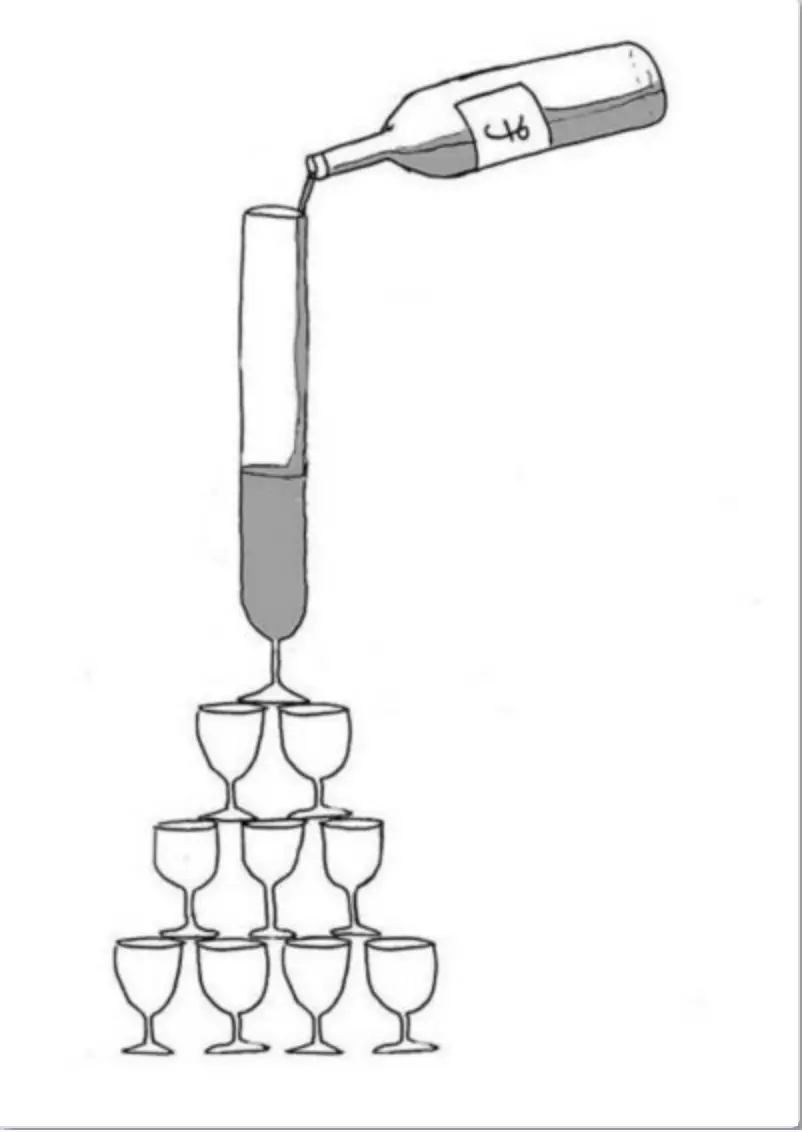

Trickle Down Economics Explained

- Thread starter charliegolf

- Start date

Sponsored Links

- Joined

- 22 Aug 2006

- Messages

- 5,821

- Reaction score

- 715

- Country

Don't be daft, you're showing an idealised picture. In reality a little bit would be spilt.

My bad, soz.Don't be daft, you're showing an idealised picture. In reality a little bit would be spilt.

Sponsored Links

if you read this you will see that cutting rates below 50% doesn't have the desired effect also the complications when the technique has been used.

Also consider the chart I posted with highest tax rates - why are these countries doing better than we are? One reason we can have little hope of achieving is a trade surplus. It appears to have an effect on debt. The Scandinavian countries are an example. One Finland runs at a near zero trade gap. It's debt increases. The others run with positive figures and it doesn't. They are higher tax level countries.

Trickle-Down Economics: Why It Only Works in Theory

Trickle-down economic theory states that benefits for the wealthy trickle down to everyone else in the economy. These benefits for the wealthy include tax cuts for dividends, capital gains, high-income earners, and businesses. Trickle-down economics assumes that company owners, savers, and...

www.economicsonline.co.uk

Also consider the chart I posted with highest tax rates - why are these countries doing better than we are? One reason we can have little hope of achieving is a trade surplus. It appears to have an effect on debt. The Scandinavian countries are an example. One Finland runs at a near zero trade gap. It's debt increases. The others run with positive figures and it doesn't. They are higher tax level countries.

- Joined

- 31 May 2016

- Messages

- 17,911

- Reaction score

- 2,698

- Country

Income tax is just part of the mix. Comparing personal taxation with neighbouring countries without also looking at capital gains and the corporation tax structure and more importantly the exemptions is nuts.

On paper Luxembourg is in the mix from a tax perspective, but anyone in business knows, its the place to channel dividend payments.

On paper Luxembourg is in the mix from a tax perspective, but anyone in business knows, its the place to channel dividend payments.

- Joined

- 22 Aug 2006

- Messages

- 5,821

- Reaction score

- 715

- Country

The bankers' pay cap thing, I can accept could have a very strong trickle-down effect by bringing a whole load of work/ers to the country.

After that, I don't know, but it feels wrong. once you're without "super tax". I think Truss is nuts for not even trying to explain how it's supposed to work.

After that, I don't know, but it feels wrong. once you're without "super tax". I think Truss is nuts for not even trying to explain how it's supposed to work.

She was a remainer Lib Dem who turned into a right wing brexiteer nut job!I think Truss is nuts for not even trying to explain how it's supposed to work.

All for her own benefit....

No wonder the UK is now too far down the sh*t pipe to ever recover...

All due to the traitorous brexiteers!

House price crash - Graham Cox, director of Bristol-based Self Employed Mortgage Hub:

UK the sick man of Europe again - Lewis Shaw, founder of Mansfield-based Shaw Financial Services:Unless the government steadies the ship, we're heading for a house price crash of 20-40% over the next couple of years. There's 1.8m borrowers coming off fixed rate deals next year. They simply won't be able to afford the mortgage payments, forcing them to sell or be repossessed.

UK property market likely to be flooded with interest from overseas - Edgar Rayo, chief economist at London-based finance broker, Finanze:It has taken less than 18 months for the UK to become the sick man of Europe once again. At every stage in this debacle, we've been on the back foot. We need to regain momentum, which will mean real economic pain. The fiscal event last week by Kami-Kwasi has the potential to turn the UK into an emerging market, or worse still, a failed state.

UK economy officially on red alert - Anil Mistry, director at Leicester-based RNR Mortgage Solutions:Expect wealthy foreign investors from China and the Middle East to flood the UK property market with enquiries for property bargains just like what happened in 2016 when the pound slid to a 31-year low after the Brexit vote.

Government running on empty - Rhys Schofield, managing director at Derbyshire-based mortgage advisors Peak Money:The ramifications of (the chancellor's budget) are extraordinary and the UK economy is now officially on red alert. This will now lead to more expensive fuel prices, leading to more expensive everyday goods as transport costs increase, plus more expensive imported goods.

Banana republic - Rob Gill, managing director at mortgage broker Altura Mortgage Finance:Remember that magic money tree that the Tories used to bang on about? Seems that it does actually exist when it means giving tax cuts to your donor chums. I can't actually recall a government more out of touch with the country and after 12 years in charge. This lot are definitely running on empty.

A currency in freefall, the soaring cost of borrowing and a government and central bank pulling in opposite directions is the stuff of a banana republic.

Yes, but it's not all good news, ellal, there's a cold wind a-blowing in from the north.She was a remainer Lib Dem who turned into a right wing brexiteer nut job!

All for her own benefit....

No wonder the UK is now too far down the sh*t pipe to ever recover...

All due to the traitorous brexiteers!

House price crash - Graham Cox, director of Bristol-based Self Employed Mortgage Hub:

UK the sick man of Europe again - Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

UK property market likely to be flooded with interest from overseas - Edgar Rayo, chief economist at London-based finance broker, Finanze:

UK economy officially on red alert - Anil Mistry, director at Leicester-based RNR Mortgage Solutions:

Government running on empty - Rhys Schofield, managing director at Derbyshire-based mortgage advisors Peak Money:

Banana republic - Rob Gill, managing director at mortgage broker Altura Mortgage Finance:

If only liz would tell me who my designated rich person was I could cut out the middleman and send them my life savings directly.

- Joined

- 31 May 2016

- Messages

- 17,911

- Reaction score

- 2,698

- Country

I personally wouldn't take advice from a Managing director's of a firm of <20 people. These comments are probably designed to drive "brand awareness".

Struggling to pay your mortgage due to the tory budget? My team of expert financial advisors can re-sell you a new one and make a packet in commission"

I believe it would be the designated rich person of 98 other people along with you to keep them in the lifestyle that they don't deserve...If only liz would tell me who my designated rich person was I could cut out the middleman and send them my life savings directly.

Of course when push comes to shove, I'm wondering how is that 1 person going to keep the 99 (including you) at bay?

Can't come quickly enough in my opinion!

- Joined

- 25 Jul 2022

- Messages

- 12,881

- Reaction score

- 1,019

- Country

The amusing (but still painful) bit is that the supporters of this chaos of a government (small g on purpose) were supporters of Boris and Rishi until they were replaced.

They were right then, and right now?

Or wrong then and right now?

Or right then and wrong now?

or none of the above?

They were right then, and right now?

Or wrong then and right now?

Or right then and wrong now?

or none of the above?

D

Deleted member 18243

Commies!

- Joined

- 25 Jul 2022

- Messages

- 12,881

- Reaction score

- 1,019

- Country

Tangent. Off on 1Commies!

Sponsored Links

Similar threads

- Replies

- 33

- Views

- 2K