- Joined

- 11 Jan 2004

- Messages

- 43,859

- Reaction score

- 2,868

- Country

Now, some people consider that HMRC are rip-off merchant at the best of times.

I had to complete 2 SA tax returns in April, for 12-13 and 13/14.

I was in hospital at the time but nevertheless, got them sent off, with proof of posting: a tracking number and a signature copied from the on-line entry showing date and time signed for.

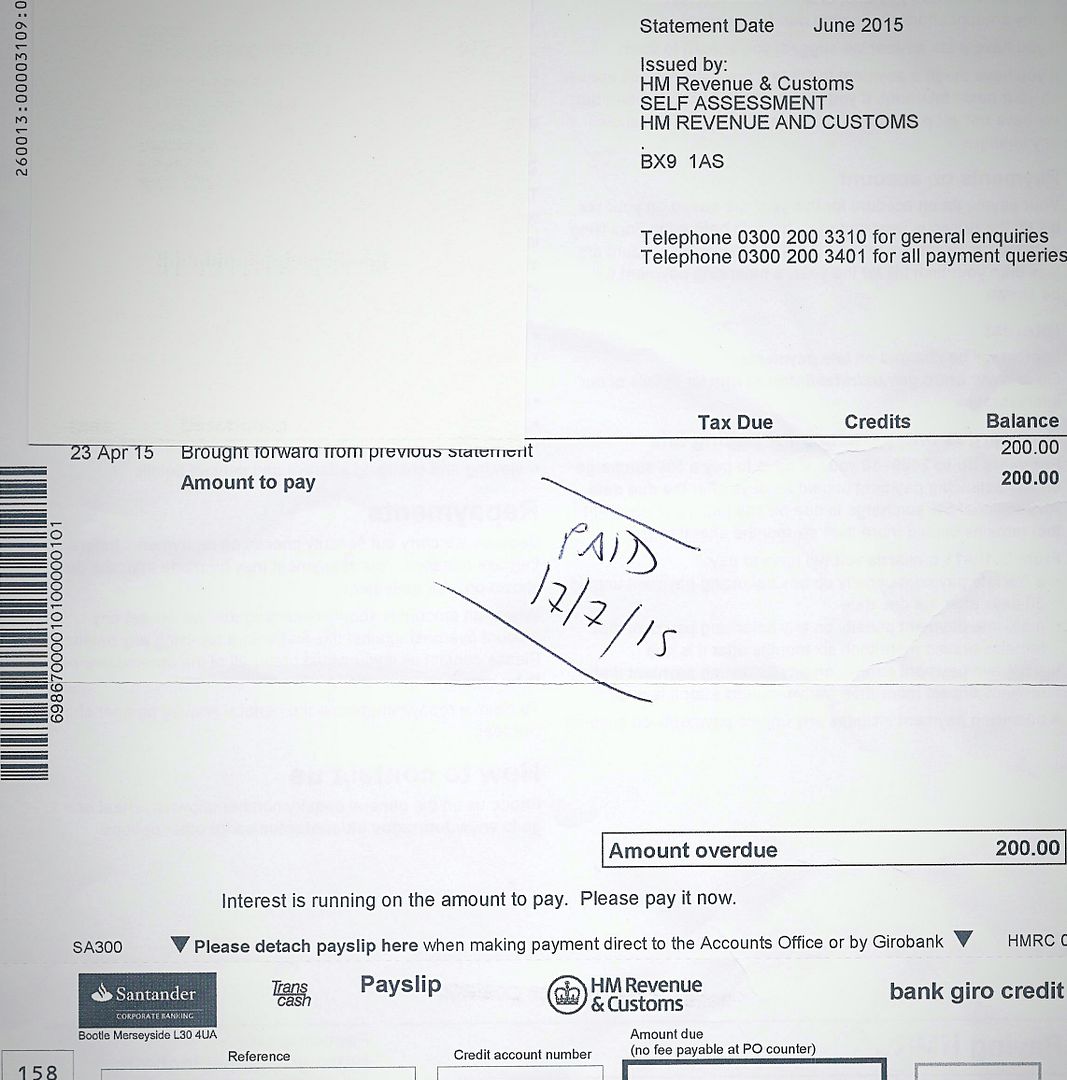

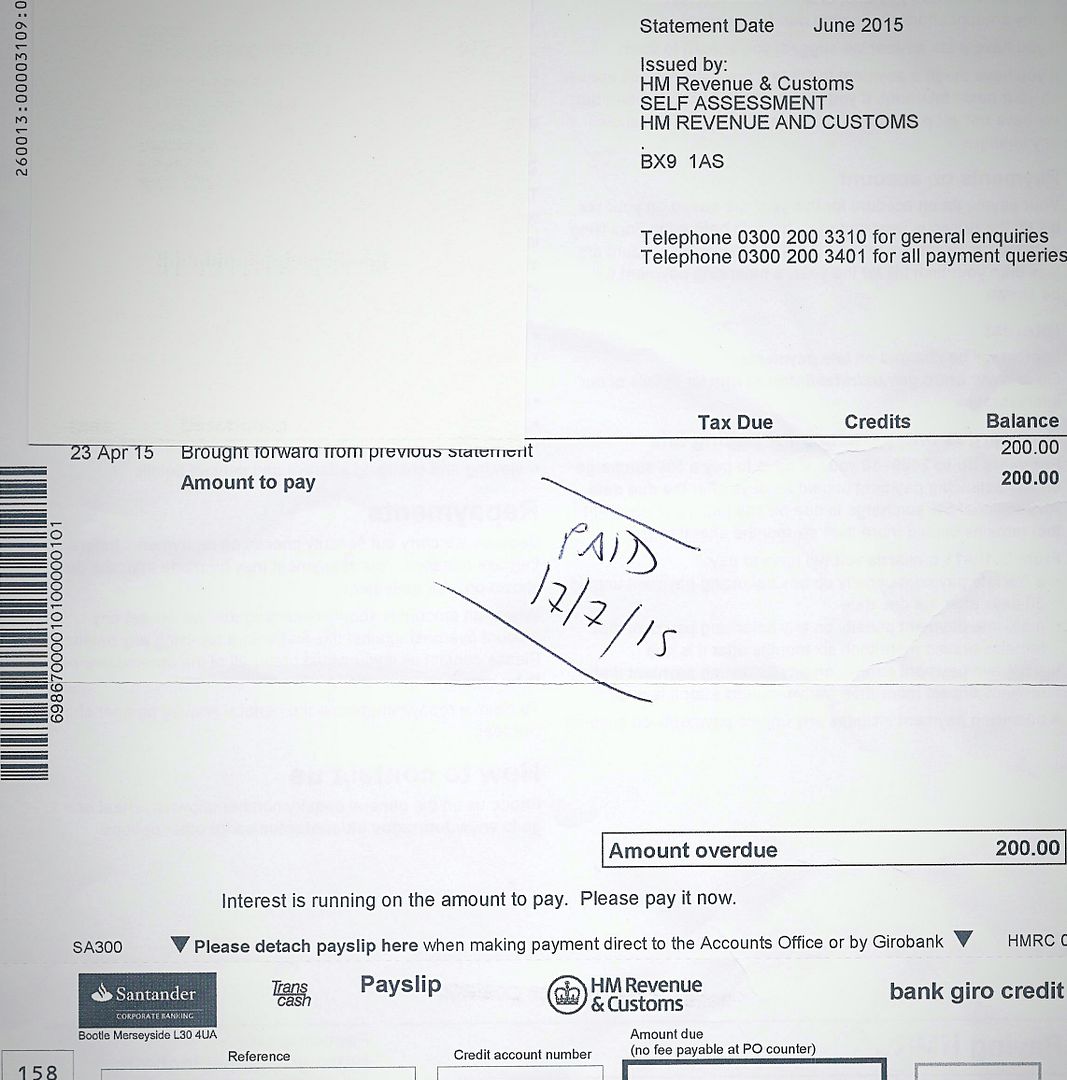

Now, I got a bill in July for £200. No mention of what it was for.

I assumed it was for tax owed.

So today I got two letters from HMRC, SA302's (tax calculation letters, one for each tax year).

One said I owed them money, the other said I had a rebate due. Balancing them out, I owe HMRC £80.

But there was no mention of the £200 paid.

So I rang up (be prepared for a long wait - mine was 79 minutes).

It turns out the £200 I paid was for penalties because I returned my TR's late.

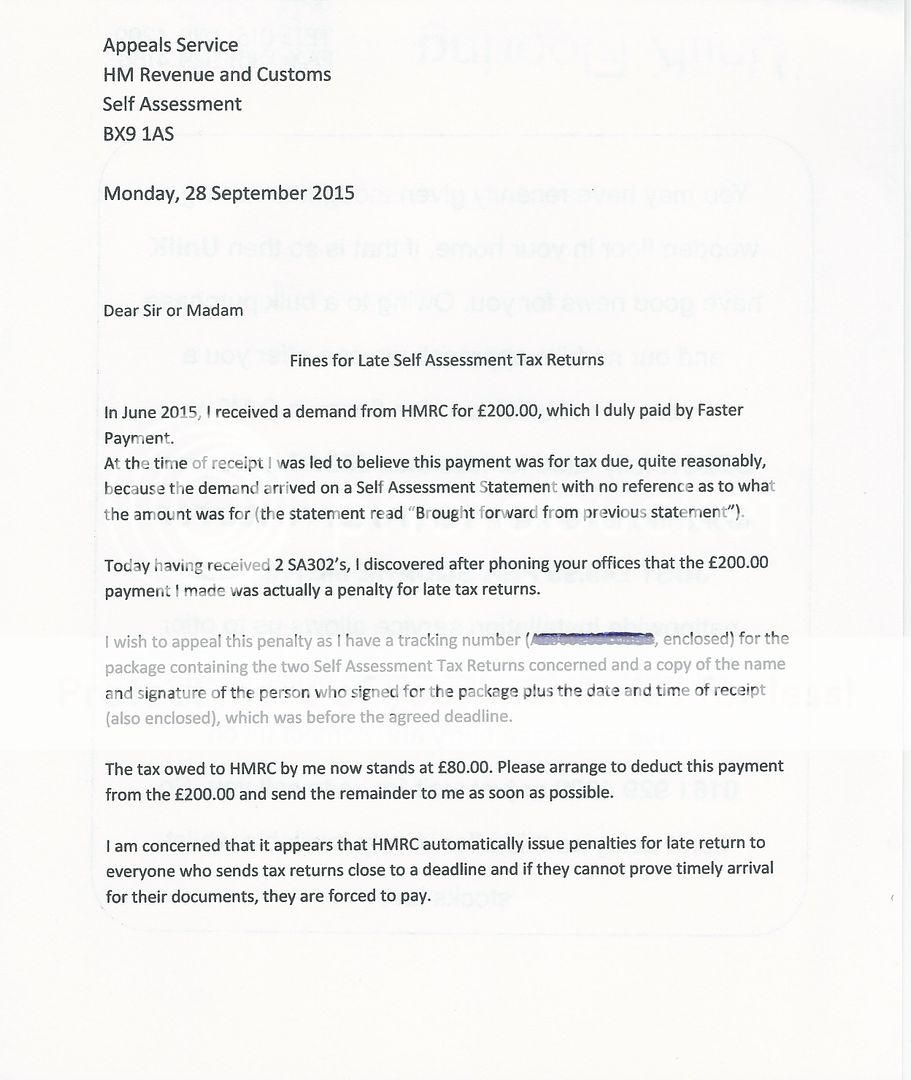

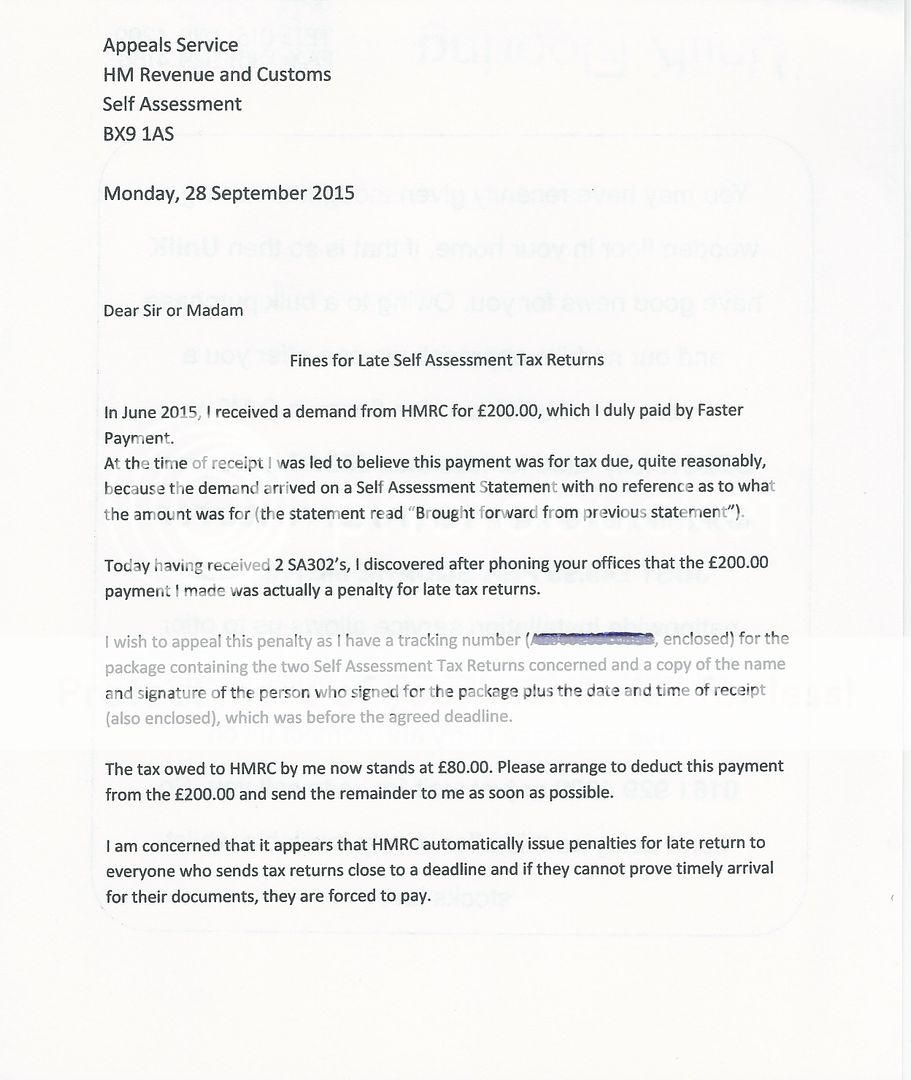

So now I have to go through the rigmarole of copying stuff and sending a letter (signed for....) so I can "appeal" a payment that should never have been taken.

Never mind any interest or compensation for my time.

This is the rip-off, though: read the last para of the letter:

I had to complete 2 SA tax returns in April, for 12-13 and 13/14.

I was in hospital at the time but nevertheless, got them sent off, with proof of posting: a tracking number and a signature copied from the on-line entry showing date and time signed for.

Now, I got a bill in July for £200. No mention of what it was for.

I assumed it was for tax owed.

So today I got two letters from HMRC, SA302's (tax calculation letters, one for each tax year).

One said I owed them money, the other said I had a rebate due. Balancing them out, I owe HMRC £80.

But there was no mention of the £200 paid.

So I rang up (be prepared for a long wait - mine was 79 minutes).

It turns out the £200 I paid was for penalties because I returned my TR's late.

So now I have to go through the rigmarole of copying stuff and sending a letter (signed for....) so I can "appeal" a payment that should never have been taken.

Never mind any interest or compensation for my time.

This is the rip-off, though: read the last para of the letter: