- Joined

- 24 Sep 2005

- Messages

- 6,345

- Reaction score

- 269

- Country

Don't panic - just yet.

I believe GB debt is mainly long term whereas some other countries are into disastrous short term debt.

That final paragraph suggests roughly the equivalent of someone grossing pay of £30k p/a making debt interest only payments at 3% of gross pay p/a, something like £900 or £75 a month on a loan of 0.64 x 30k = 19.2k

Hardly breaking the bank - or is it?

-0-

I believe GB debt is mainly long term whereas some other countries are into disastrous short term debt.

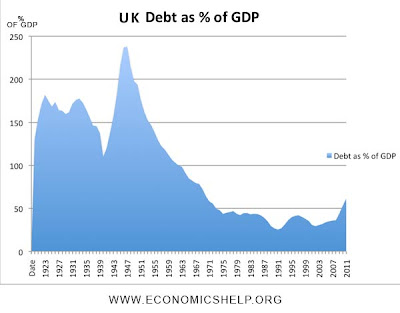

[url=http://www.economicshelp.org/blog/uk-economy/uk-national-debt/]Economics Help[/url] said:...Since 2008, National Debt has increased sharply because of:

Economics Recession (lower tax receipts, higher spending on unemployment benefits)

Financial bailout of Northern Rock, RBS and other banks.

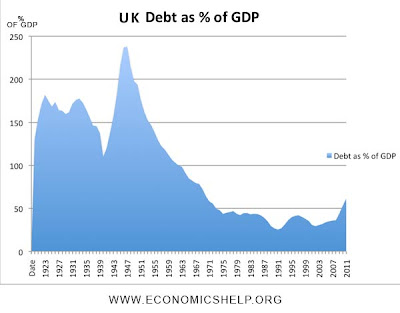

Although 64% of GDP is a lot it is worth bearing in mind, that other countries have a much bigger problem. Japan for example have a National debt of 194%, Italy is over 100%. The US national debt is close to 71% of GDP. [See other countries Debt] . Also the UK has had much higher National Debt. e.g. after the second world war it was over 180% of GDP.

Cost of National Debt

The cost of National debt is the interest the government has to pay on the bonds and gilts it sells. In the first six months of 2010, the debt interest payments were £21.6bn, suggesting an annual cost of around £43bn (3% of GDP)...

That final paragraph suggests roughly the equivalent of someone grossing pay of £30k p/a making debt interest only payments at 3% of gross pay p/a, something like £900 or £75 a month on a loan of 0.64 x 30k = 19.2k

Hardly breaking the bank - or is it?

-0-