You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

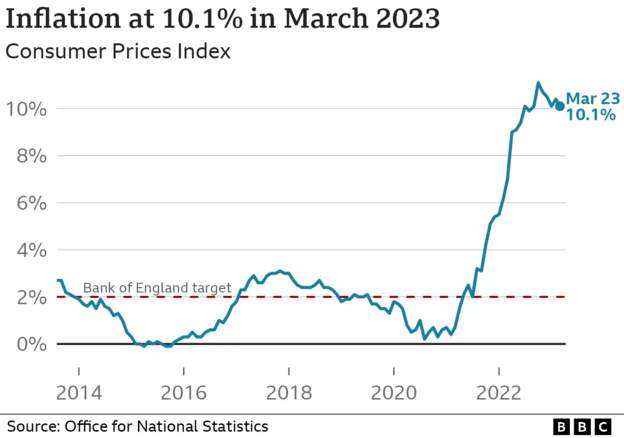

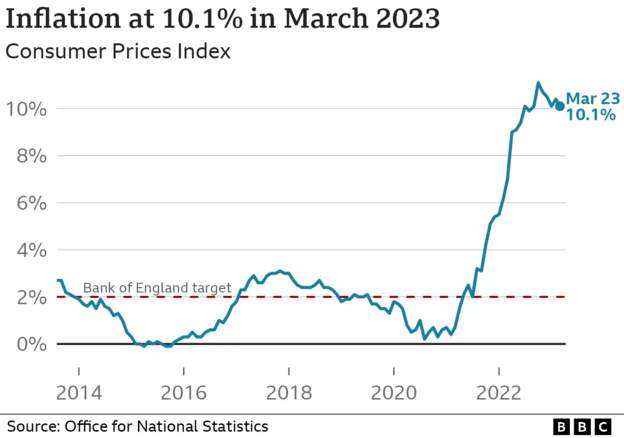

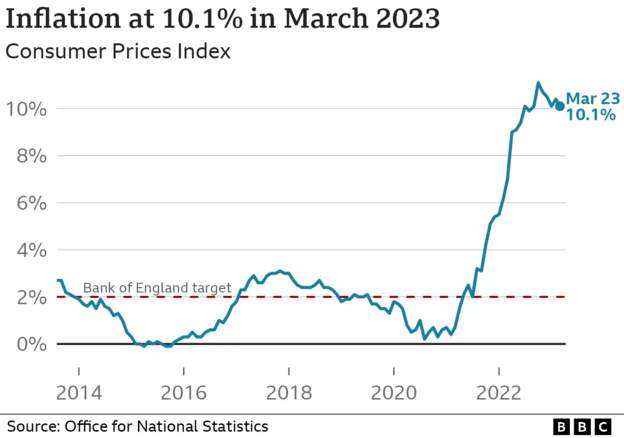

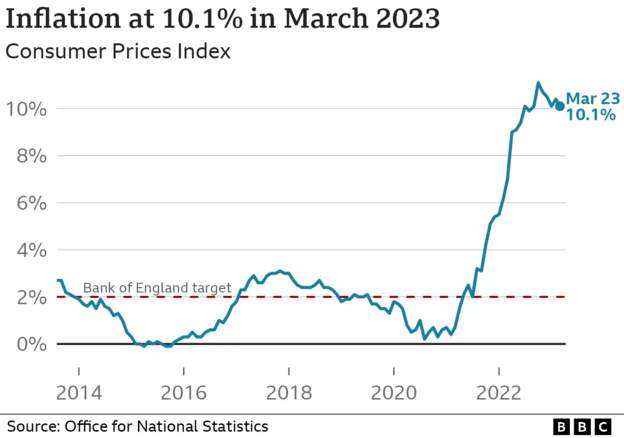

UK inflation returns to 40-year high of 10.1%

- Thread starter JohnD

- Start date

(gone pic no.37)

Ah, so you're one of the people he was trying to appeal to.

Is that from your personal 'bank?

You are an ingratiating *******, aren’t you?

, you serious suck-arse!

Me too.Rude. I’m hurt!

You usually are going round in circles.Feck me, I’m going mad. I’ve got Pat ex answering for JohnD and JohnD answering for Pat ex. Neither of them get 'irony'.

Don't worry, neither of us are wearing white coats.

When the men in white coats come for you, that'll be the time to worry.

- Joined

- 25 Jul 2022

- Messages

- 18,975

- Reaction score

- 1,625

- Country

You dont believe that, do you ?You see, chancellors can wield as much power as a PM.

He has been put in place as chancellor and PM, leaving her with the title to take the flak.

Chancellors do have clout but the PM gets to make the final call and general direction, unless they have been silently moved out the way

- Joined

- 25 Jul 2022

- Messages

- 18,975

- Reaction score

- 1,625

- Country

IronyAnd you really think I’m hurt by JD's comment and feel the need to spring to his defence by searching through my old posts?

Some interesting info came out last night. The triple lock inflation is set on the basis of inflation in September. So looks like that will be 10.1%. One point is that inflation on basics is ~15%, some higher however inflation over the year on them is ~40%. Probably unusually high but the use of Sept is interesting. Most people are probably aware of pre and post Xmas price increases. September avoids those and the choice is probably down to historic inflation behaviour. Then when is it used - the following Apr.

The other trick is to clamp down increases. Say wages and the min wage. Then increase them by more than usual but not enough to make up for the previous clamps.

The net effect is more and more moving into various poverty levels and also many others noticing a decline in their living standards.

Then the TUC points out that we have had 2 decades of stagnant wage growth. It's essentially correct for a lot of people.

The other trick is to clamp down increases. Say wages and the min wage. Then increase them by more than usual but not enough to make up for the previous clamps.

The net effect is more and more moving into various poverty levels and also many others noticing a decline in their living standards.

Then the TUC points out that we have had 2 decades of stagnant wage growth. It's essentially correct for a lot of people.

There are of course some idiots who believe that nothing bad can happen to them...The net effect is more and more moving into various poverty levels and also many others noticing a decline in their living standards.

I wonder how loud they will be squealing when nobody comes running to help them when their world comes tumbling down?

Because they didn't give a monkey's about anyone else but themselves!

Don't hold your breath, a new chancellor reversed the previous chancellor's budget.Some interesting info came out last night. The triple lock inflation is set on the basis of inflation in September.

A new PM can just as easily reverse Liz Truss's announcement, and it wouldn't surprise me in the least if they did.

Even if it was put before Parliament, it can be reversed by Parliament.

The BoE is widely expected to put interest rates up again for a 12th consecutive time today - from 4.25% to 4.5% - meaning mortgage and loan payments go up (again) for many people.

Meanwhile; Uk inflation remains as high as it did when Rish! rode to the rescue...

However, America's annual rate of inflation has fallen sharply since hitting a 40-year high of 9.1% last June. April’s rise nearly matched the 5% rise recorded in March. It was the 10th consecutive month the rate has declined, but prices are still rising at a rate that is more than twice the Federal Reserve’s target rate of 2% a year.

What are they doing right while the Tory government persistently keeps getting it so wrong?

Meanwhile; Uk inflation remains as high as it did when Rish! rode to the rescue...

However, America's annual rate of inflation has fallen sharply since hitting a 40-year high of 9.1% last June. April’s rise nearly matched the 5% rise recorded in March. It was the 10th consecutive month the rate has declined, but prices are still rising at a rate that is more than twice the Federal Reserve’s target rate of 2% a year.

What are they doing right while the Tory government persistently keeps getting it so wrong?

- Joined

- 1 Apr 2016

- Messages

- 13,606

- Reaction score

- 550

- Country

The BoE is widely expected to put interest rates up again for a 12th consecutive time today - from 4.25% to 4.5% - meaning mortgage and loan payments go up (again) for many people.

Meanwhile; Uk inflation remains as high as it did when Rish! rode to the rescue...

However, America's annual rate of inflation has fallen sharply since hitting a 40-year high of 9.1% last June. April’s rise nearly matched the 5% rise recorded in March. It was the 10th consecutive month the rate has declined, but prices are still rising at a rate that is more than twice the Federal Reserve’s target rate of 2% a year.

What are they doing right while the Tory government persistently keeps getting it so wrong?

UK inflation rate: How quickly are prices rising?

The rate at which prices are rising has dropped below the Bank of England's target of 2%.

www.bbc.co.uk

To expand on this, there are two types of inflation - cost push - when prices are rising and demand pull when there is excess demand and people are willing to pay more.

So looking at the charts its the cost of food and housing, looking at food we are simply importing inflation from abroad and as the pound has weakened compared to the Euro.

As to housing as we do not build enough homes then rents have been increasing.

Factor in Truss horrific budget and we are still paying the price of that inflationary mess on top of the decade plus mess of Tory policies.

Brexit has raised food costs because it has created more friction in the supply chain.

So looking at the charts its the cost of food and housing, looking at food we are simply importing inflation from abroad and as the pound has weakened compared to the Euro.

Pounds at a five month high.

Pound at Fresh 6-Month Best against Euro, Bank of England is Key Risk

For the Best News, Forecasts, Exchange Rate Data and Transfer Comparisons

- Joined

- 1 Apr 2016

- Messages

- 13,606

- Reaction score

- 550

- Country

Pounds at a five month high.

Pound at Fresh 6-Month Best against Euro, Bank of England is Key Risk

For the Best News, Forecasts, Exchange Rate Data and Transfer Comparisonswww.poundsterlinglive.com

What was the pound in 2015?

- Joined

- 1 Apr 2016

- Messages

- 13,606

- Reaction score

- 550

- Country

Pounds at a five month high.

Pound at Fresh 6-Month Best against Euro, Bank of England is Key Risk

For the Best News, Forecasts, Exchange Rate Data and Transfer Comparisonswww.poundsterlinglive.com

5 months ago the pound on dec 11th was 1.16 today its 1.15 vs the euro.

This is how the US are doing it...................The BoE is widely expected to put interest rates up again for a 12th consecutive time today - from 4.25% to 4.5% - meaning mortgage and loan payments go up (again) for many people.

Meanwhile; Uk inflation remains as high as it did when Rish! rode to the rescue...

However, America's annual rate of inflation has fallen sharply since hitting a 40-year high of 9.1% last June. April’s rise nearly matched the 5% rise recorded in March. It was the 10th consecutive month the rate has declined, but prices are still rising at a rate that is more than twice the Federal Reserve’s target rate of 2% a year.

What are they doing right while the Tory government persistently keeps getting it so wrong?

US debt ceiling - what it is and why there is one

Congress has approved a deal on the debt limit. But what is the debt ceiling and why does it exist?

Woop-di-doo.Pounds at a five month high.

"If we cast out eyes back to just before the Brexit vote, sterling was held up at just over €1.40 against the euro and $1.50 against the US dollar."

"The effect of Brexit was particularly evident immediately after the referendum result, as sterling experienced its largest fall within a single day in 30 years. There were two further substantial and sustained falls in 2017 and 2019"

Remember June 2016?

Similar threads

- Replies

- 53

- Views

- 5K

- Replies

- 8

- Views

- 1K