You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

winning..........

- Thread starter mlb3c

- Start date

Sponsored Links

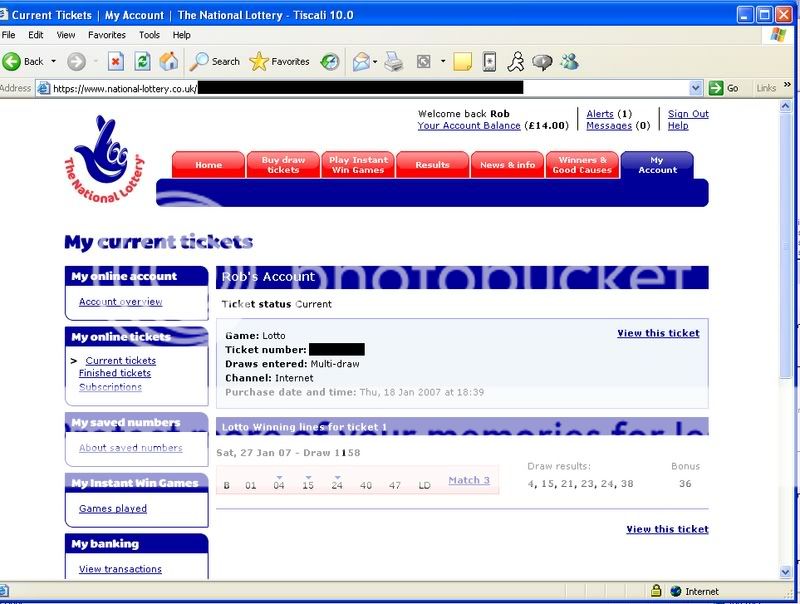

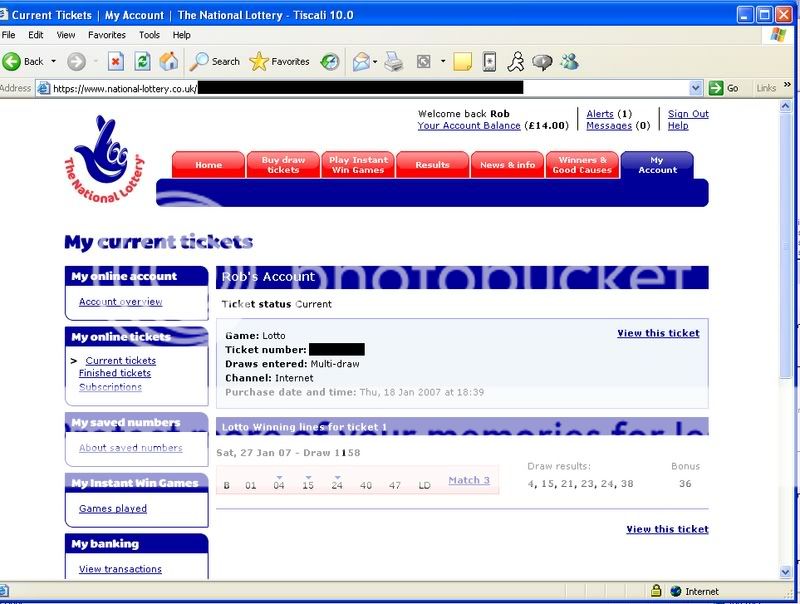

I won a tenner on the lottery last saturday

Sponsored Links

I won £20 last week on the sat lotto havent checked last night's yet, but i can imagine i've gone back into the routine of winning naff all!

Just last week I won a 'Lady's Golf Umbrella' and a bottle of white wine (my name was drawn out of a high hat filled with replies to an email from our insurer about new website names for an ecofriendly insurers scheme).

Umbrella is always handy, but I don't drink wine

Umbrella is always handy, but I don't drink wine

I won the heart of a beautiful lady....... but decided to keep the wife instead.

I've won two things. An XBOX 360 in a reverse auction (the lowest unique bid things) with 3 mobile and £500 free servicing from Auto Express.

Never won a penny on the lotto.

Oh, actually, I win things all the time on those free scratch cards in the junkmail. You know the ones, where you've gotta phone a £1.50 a minute number to claim. I don't think that's classed as winning though and I've never been soft enough to call and claim.

Never won a penny on the lotto.

Oh, actually, I win things all the time on those free scratch cards in the junkmail. You know the ones, where you've gotta phone a £1.50 a minute number to claim. I don't think that's classed as winning though and I've never been soft enough to call and claim.

I have been told that you've got more chance of winning is to have £1100 on the premium bonds, 2 of my friends are always winning on that amount, is it true or anyone? My uncle has won £10,000 on that amount as well last year.JohnD said:I've won hundred on pounds on Premium Bonds. Got my stake back, too.

Never lost a penny on the Lotto.

The prizes are random.

So just as, if you buy a million Lotto tickets, you have more chance of winning than if you only buy one, if you have thousands of bonds you have more chance of winning.

I've forgotten the odds, but (remembering that most of the prizes are £50 and you have negligible chance of winning a million, if the interest rate was 5% (which it isn't) and you invested say £10,000 you would expect to get £500 a year interest, so you could expect about £500 a year prizes on average, so about ten a year on average. But, since it's random, there's no reason why you shouldn't win a hundred prizes one year, and none the next.

But with bigger holdings, it does tend to average out at about the published rate.

The payment rate is set to give an average return of about the same as the interest on a typical savings account, net of basic tax. (prizes are not taxable). So if you are a higher-rate taxpayer it makes a reasonable place to tuck a wedge of money, with the slim chance of winning a million. And of course you can always get your stake back, with little risk of the fund going bust.

So just as, if you buy a million Lotto tickets, you have more chance of winning than if you only buy one, if you have thousands of bonds you have more chance of winning.

I've forgotten the odds, but (remembering that most of the prizes are £50 and you have negligible chance of winning a million, if the interest rate was 5% (which it isn't) and you invested say £10,000 you would expect to get £500 a year interest, so you could expect about £500 a year prizes on average, so about ten a year on average. But, since it's random, there's no reason why you shouldn't win a hundred prizes one year, and none the next.

But with bigger holdings, it does tend to average out at about the published rate.

The payment rate is set to give an average return of about the same as the interest on a typical savings account, net of basic tax. (prizes are not taxable). So if you are a higher-rate taxpayer it makes a reasonable place to tuck a wedge of money, with the slim chance of winning a million. And of course you can always get your stake back, with little risk of the fund going bust.

Come to think of it I won an Ipod mini from a bag of walkers crisps last summer, in their "An Ipod to be won every ten minutes" competition.

I also won £500 on the premium bonds a few years ago.

I won a best drawing competition for a picture of King Rollo in "buttons" comic when I was five years old.

http://en.wikipedia.org/wiki/King_Rollo

I also won £500 on the premium bonds a few years ago.

I won a best drawing competition for a picture of King Rollo in "buttons" comic when I was five years old.

http://en.wikipedia.org/wiki/King_Rollo

Sponsored Links