I can't really other than these are who lot of the proletariat are

Payrolled employees. Early estimates for April 2022 indicate that there were 29.5 million payrolled employees (Figure 1), a rise of 4.2% compared with the same period of the previous year. This means a rise of 1,187,000 people over the 12-month period.

That makes up a lot of them or should I say us. They need the tax take. Over all for all the lowest rate will provide most of it. Even higher earners pay that up to some point.

Pundits - well they say things. They may be true or they may not be so in this case only the actions taken can be used to judge. Tory actions tend to have things in common. 1p of the basic rate does next to nothing for low earners. A wonderful tax allowance of £12570 it seems took a number out of taxation. Can't remember the numbers but it wasn't a few and indicates how low earnings may be. So you want to help these people - you give it to the majority of people?

The libs are no better, it's a crowd pleaser. Reduces tax take with nothing to replace it other than growth or inflation. Wage growth for a lot has been low.

The basic state pension is £7,376. Some people live on it ~£140 a week.

NI doesn't pay for the NHS it pays for other support services. The basic idea is employers pay some of it for having a healthy workforce. Tamper with that as well.

The Tory party as all ERGish and low tax fixes all yet taxation is clearly in a mess in terms of what it should provide.

From my point of view it seems we will be getting some sort of taxation increase and I wonder just how the Tory will do that. A 1p chnage in the basic rate represents £5b. 5p on the higher rate £2b. They appear to be looking for some number greater than £10b but pundits reckon between 20 and 40 b.

I'm sorely disapointed that the details aren't coming out at the end of the month. Have to wait another 2 1/2 weeks.

One pundit said that a country set up like the UK can not run with USA tax rates. Those are shown nere

Detailed description of taxes on individual income in United States

taxsummaries.pwc.com

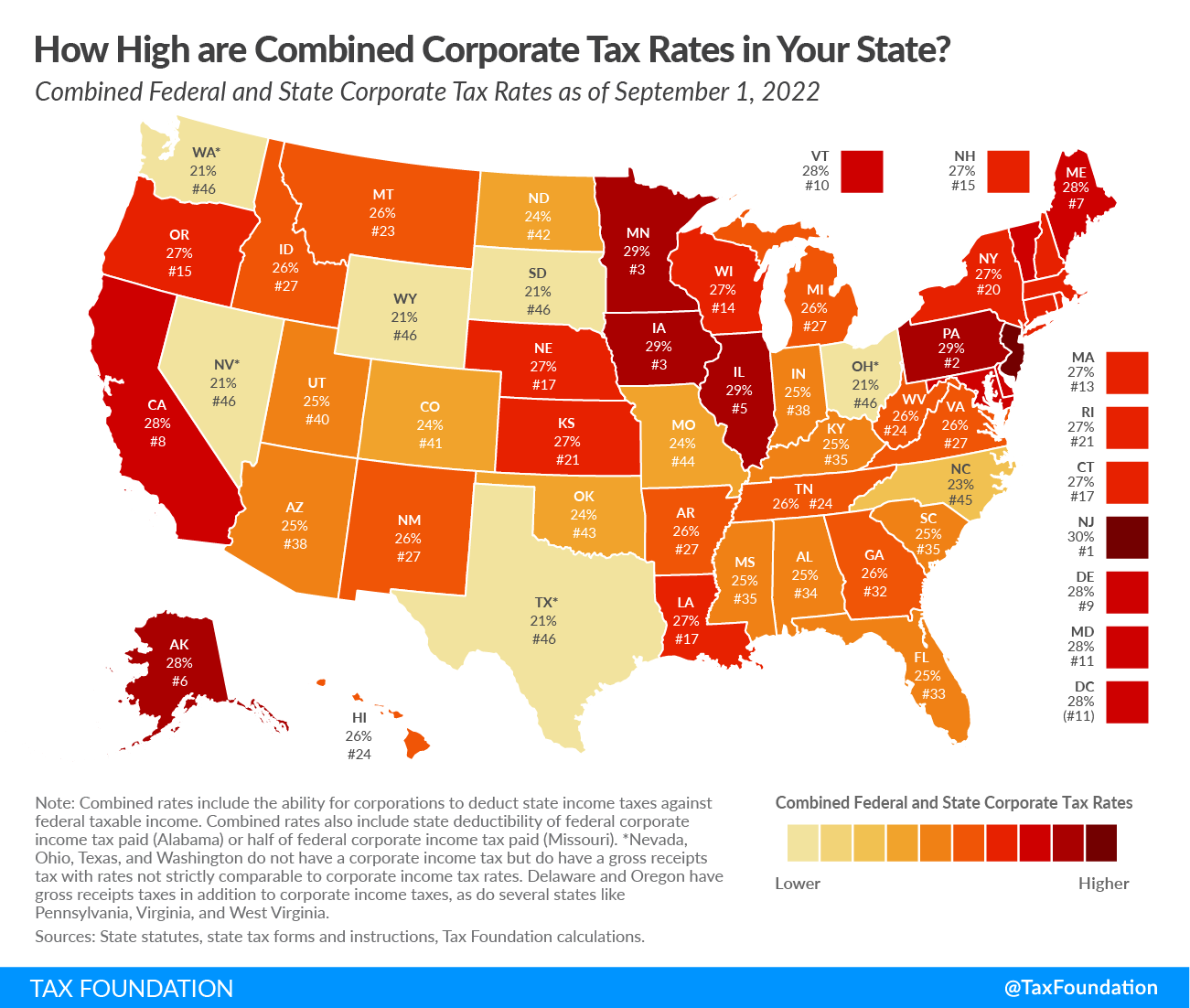

Their corporation tax has it's interesting points as well

When examining tax burdens on businesses, it is important to consider both federal and state corporate taxes. Corporate taxes are one of the most economically damaging ways to raise revenue and are a promising area of reform for states to increase competitiveness and promote economic growth...

taxfoundation.org

Not the usual type this time just an internal Tory war cabinet Sunak unites.

Not the usual type this time just an internal Tory war cabinet Sunak unites.