Will do.Just hang on in there my yellow skinned friends.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

joe's dire predictions.

- Thread starter securespark

- Start date

Sponsored Links

- Joined

- 28 Oct 2005

- Messages

- 31,281

- Reaction score

- 1,997

- Country

Sorry folks, but interest rates will rise. If our National Debt continues to rise like Davy Boy is allowing it to, then we become a risk. As a risk we will have to pay higher rates. Basically, we'll be in the grips of the Pay-day lenders before long. We already pay £70 billion in interest payments every year. When interest rates double - or our National Debt doubles (again) we'll pay £140 Billion. We just can't do that and reduce the debt at the same time. We are twinned with Greece.

I have heard that figure several times.

I have heard it is monthly.

Could someone please tell me where this £70b (£960b pa?) goes?

What is the interest rate?

Are we being ripped off by International Wonga?

As every country seems to be in debt who has lent it to us?

I have heard it is monthly.

Could someone please tell me where this £70b (£960b pa?) goes?

What is the interest rate?

Are we being ripped off by International Wonga?

As every country seems to be in debt who has lent it to us?

Could someone please tell me where this £70b (£960b pa?) goes?

What is the interest rate?

Are we being ripped off by International Wonga?

As every country seems to be in debt who has lent it to us?

And still the government sees fit to give away millions to (supposed) third world countries. You know the ones out East which have nuclear programs, space programs etc , yet can't feed 90% of their population.

Sponsored Links

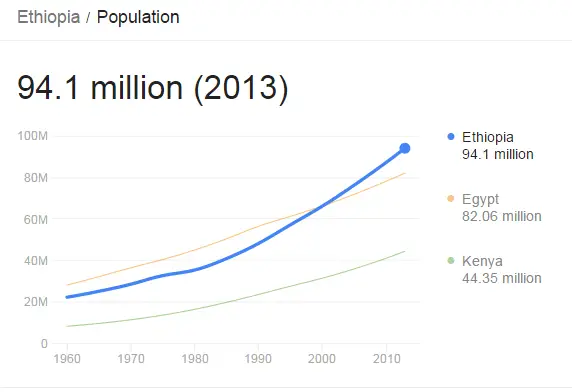

I was going to say they would as there's plenty of space in Ethiopia, then came across this -

so, maybe not.

Wow

so, maybe not.

Wow

You mean when the bank of England base rate doubles, the UKs debt repayment will go up too?Sorry folks, but interest rates will rise. If our National Debt continues to rise like Davy Boy is allowing it to, then we become a risk. As a risk we will have to pay higher rates. Basically, we'll be in the grips of the Pay-day lenders before long. We already pay £70 billion in interest payments every year. When interest rates double - or our National Debt doubles (again) we'll pay £140 Billion. We just can't do that and reduce the debt at the same time. We are twinned with Greece.

You said when the interest rate doubles in your post.When the national debt doubles. When the UKs borrowings double. You need to revisit history.

You really have no idea what you are talking about.

You took an awful long time to fathom that out.You really have no idea what you are talking about.

- Joined

- 28 Oct 2005

- Messages

- 31,281

- Reaction score

- 1,997

- Country

God you lot are thick. If the interest rate on our debt doubles - we pay twice as much interest. Are you with me so far?

If the Interest rate stays the same but our debt doubles - we pay twice as much interest. Have I lost you yet?

My guess is that Gideon and his Eton Pals will double the debt. Then we become a risk so the interest rate will double.

In other words we will pay four times in interest what we currently pay. That's £280 billion in interest each year.

London - twinned with Athens.

If the Interest rate stays the same but our debt doubles - we pay twice as much interest. Have I lost you yet?

My guess is that Gideon and his Eton Pals will double the debt. Then we become a risk so the interest rate will double.

In other words we will pay four times in interest what we currently pay. That's £280 billion in interest each year.

London - twinned with Athens.

I don't understand what you think will happen to interest rates.

The government has sold long-term bonds with a fixed interest rate and (usually) repayment date to fund its debt. That interest rate for existing debt will not change.

When it wants more money, it will offer some more bonds. The price paid will depend on the interest rate that the lenders want, and their view of the credit-worthiness of the UK government (and the Scottish government, if independent). The interest rate on these future bonds might be anything. It will reflect world interest rates as well as long-term interest rates inside the UK. It might be index-linked. If it becomes known that the government intends to use inflation to shrink its debt, lenders may insist the loans are denominated in Euros or Remnimbi. A lot of these bonds may be sold to pension funds, to balance their long-term liabilities, though the declining popularity of annuities may shrivel up this demand.

It will also get some money by selling off banks it has bought, or using the Thatcher method of selling to the citizens of the nation those things which the citizens already collectively own, including town halls, civic buildings, psychiatric hospitals, bus companies and publicly owned utilities. For example next time it might sell street lamps, motorways, police stations and more hospitals.

The government has sold long-term bonds with a fixed interest rate and (usually) repayment date to fund its debt. That interest rate for existing debt will not change.

When it wants more money, it will offer some more bonds. The price paid will depend on the interest rate that the lenders want, and their view of the credit-worthiness of the UK government (and the Scottish government, if independent). The interest rate on these future bonds might be anything. It will reflect world interest rates as well as long-term interest rates inside the UK. It might be index-linked. If it becomes known that the government intends to use inflation to shrink its debt, lenders may insist the loans are denominated in Euros or Remnimbi. A lot of these bonds may be sold to pension funds, to balance their long-term liabilities, though the declining popularity of annuities may shrivel up this demand.

It will also get some money by selling off banks it has bought, or using the Thatcher method of selling to the citizens of the nation those things which the citizens already collectively own, including town halls, civic buildings, psychiatric hospitals, bus companies and publicly owned utilities. For example next time it might sell street lamps, motorways, police stations and more hospitals.

Oh, I knew it in previous threads that got a lot longer than this one will, I hope. I just take some sort of perverse pleasure in pointing it out to him. Over and over and over again when he spouts such rubbish!You took an awful long time to fathom that out.You really have no idea what you are talking about.

Who will double this interest rate? Do you know who sets it?God you lot are thick. If the interest rate on our debt doubles - we pay twice as much interest. Are you with me so far?

If the Interest rate stays the same but our debt doubles - we pay twice as much interest. Have I lost you yet?

My guess is that Gideon and his Eton Pals will double the debt. Then we become a risk so the interest rate will double.

In other words we will pay four times in interest what we currently pay. That's £280 billion in interest each year.

London - twinned with Athens.

Sponsored Links

Similar threads

- Replies

- 62

- Views

- 6K