“We’d like to live in a multipolar society, a multipolar world,”

While talk of a possible currency has focused attention on options to replace the dollar, South Africa’s BRICS ambassador, Anil Sooklal, said the goal is less about replacing the dollar than giving the world more choices.

“BRICS is not anti-West. We are not in competition,” Sooklal told Al Jazeera. “Nor are we against the dollar. But what we are against is the continued dominance of the dollar in terms of global financial interactions.”

“As the US weaponises the dollar in the Russian and Iran sanctions, there is increasing desire by other developing countries to seek alternative currencies for trade, investment, and reserves, as well as developing alternative multilateral clearance systems outside of SWIFT,” Shirley Ze Yu, a senior visiting fellow at the London School of Economics, told Al Jazeera. Yu added that as the US Federal Reserve has raised interest rates in recent years, “developing countries have widely suffered from paying higher interests on their dollar debt and battling the exchange rate impact from a strong dollar. The interest to borrow in local currencies or other currencies is strongly motivated by economic considerations”.

Considering the possible currency options, Danny Bradlow, a professor with the Centre for Advancement of Scholarship at the University of Pretoria, said he doubts many people would want to go back to the gold standard, and cryptocurrencies are an unlikely option because they are “even more risky”. “We already know that 80 percent of the trade carried about between Russia and China is settled in either Russian rubles or Chinese yuan,” he said. “Russia is also trading with India in rupees … So you’re not talking about a new currency, you’re talking about settling in the South African currency or the Russian currency.”

Even outside the core BRICS group, other countries have begun trading in local currencies. The United Arab Emirates and India last month signed an

agreement enabling them to settle trade payments in rupees instead of dollars. “Trade is no longer dominated by those countries that dominated trade in the 70s, 80s, 90s – that era is over. We also want to see a multipolarity of choices, a multipolar financial world; we don’t want to be pegged to one or two currencies as the currencies of choice,” he added. Sooklal pointed to the Pan-African payment and settlement system, a cross-border infrastructure to facilitate direct payment transactions across the continent, as a model to follow. He said it will save an estimated $5bn annually in trade transaction fees when compared with just using SWIFT.

money makes the world go mad@Al Jazz

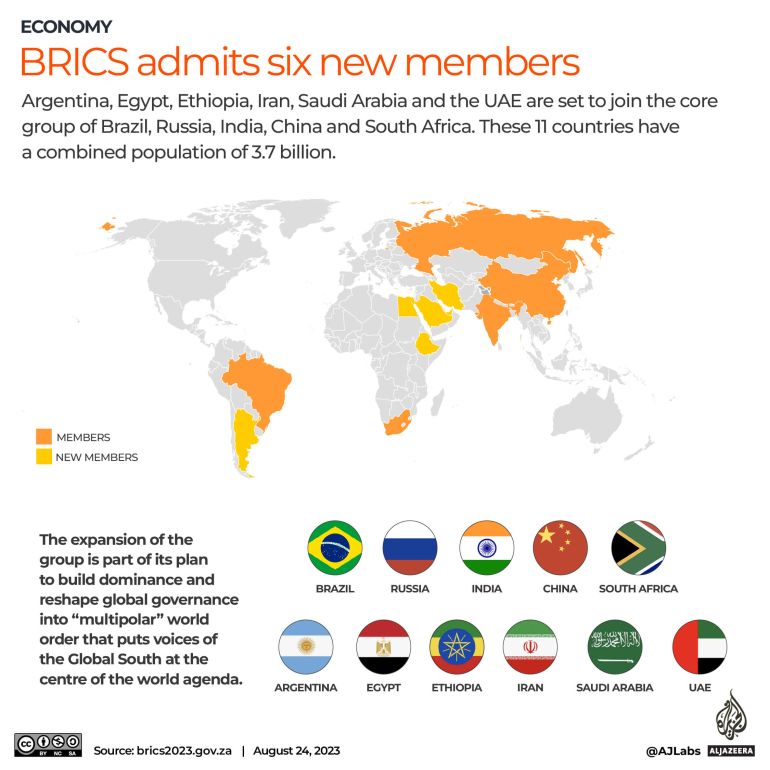

Considering the bloc holds a quarter of the global economy and almost half the worlds population it'll be interesting to see the impact Saudi Arabia and the UAE will make alongside China and India.