That must be the distance in $ under the price as it rises (or above/falls).

They have to be annoyingly far not to be caught by a wick.

I quite often (relativelly) put them on Japanese stocks which look like they might run, overnight. Ok for currency pairs too.

#Investing

I'm looking around for something to use for an account of my wife's. She doesn't like dips. . India will probably pick up where it left off but it would still get hit in a big crash. Away from stocks, in the past 6 or 3 months gold has done best, but though it may well head on to 3000, if all gets happy in tech world, it'll drop.

Some of the corp bonds are still returning about 30%pa, and some REITs are shooting up.

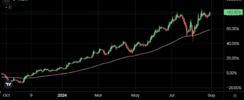

Apple could be a good buy about now, it's at the 200 MA. That doesn't happen very often. I think they have another "event" coming up which was a monster last time. At the mo they don't have a Large Language AI product in their range. They have a history of coming to the market a bit late but with a very good product. They don't have to be much better foi us to be able to say "Ok Apple here's £100k, trade it on the stock market (or the FX market) until it's £1m. Should only take a week.

Those other entry points

3spy 1285; soxl 12.05; Nail14.57.

No, it's something else. You set the pts away and a trailing step.

I can't see the 200MA on my platform, only 20,50,100 MAs. Maybe there's a way, but I didn't find it with a quick look around. Don't you need to specify what timeframe you are looking at for your MA? Daily I guess, but I don't know.