A new theme -

Investing: What's hot? This is to track my "opportunity" investing ideas. I'll say what I'm using and update it.

It is not investment advice.

Dibbling around making £X a day is all very well, but the time comes when the Xs add up to £Y.

£Y left alone can jump about in value by as much or more than X, so it makes sense to devote effort to tend to it.

Enter the stock screener, where you can look to se what has done well. A Heat Map is an easy thing to look at - see there are Sectors, like healthcare etc, within it EG

HERE

The trouble is, it changes all the time, and previous peformance doesn't guarantee future performance.

If you go too narrow, down to one stock, it can buck the mini trend - if for example one drug maker's product is found to give you cancer.

Stocks are lumped together into funds called ETFs. You can screen for those too, such as

HERE , where there are lots of things to click.

Broadly, if something has done well in the last week, month, 3 months, 6 & 12, it's likely to carry on.

How agile you can be depends on your inclination and the platform you're using.

Inclination => time, reading, and setting things.

Platforms have delays, different ranges of ETFs and/or stocks, and other types of more or less managed funds such as OEICS.

OEICS are the sort of things you find pension funds using, which have a manager who actively changes the stocks which make up the Fund. There can be dozens or more.

The easiest thing to do, is get it all wrong.

As an example, Bitcoin. It makes the news when it's high. Say it's 20% up.

So you think you'll be in with the in set, and buy bitcoin at 120.

But the price is already at the peak, by the time you've heard about it and gone through the buying mechanics.

It might rise another 2%, but then it flattens or falls back a few percent and is falling slowly.

So, dischuffed, you sell before it gets lower, at 115.

Then there's Copper doing well, so you buy copper for a similar cycle and you end up at 110. Oh dear.

One collects the T shirts.

A simple rule, using the knowledge from above, is go for what's stong, but

don't buy at the top, buy the dip,

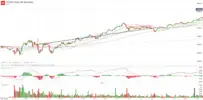

when it's rising, as long as the dip looks ordinary. I've shown several rising trends but here's a random one. Tesco. Draw the red and green lines to help - or the chart tools will do it for you as here. Buy at blue or preferably green line. If you're unlucky as at the arrow, you're in an uptrend so hold on and it'll come right - almost always.

But back to investing. I use a small number of ETFs and funds.

From

this which I posted recently I've used Semicionductors, Global technology( ), India( has been 50% ) , Corporate bond (28%), Money Market (5%), and Japan.

Lessons I've learned are to sell the exciting if the price is going flat and the "gossip" is downbeat. That's from Bloomerg, CNBC and a couple of others.

I have switched for safety to a corporate bond, mostly, which will tick over at well above 5%. One or two percent per month is fine. Some platforms only have lower rate corp bonds.

Reacting to what's rising, if there's something suitable and if you can do it in time, can pay well.

---

A couple of weeks ago I decided to use a dedicated amount for "opportunity" stocks when I find them.

I shall record the ongoing progress as a percentage

That's what prompted this post.

1) NVIDIA is the poster boy chip stock. Results are due in a week or so and are likely to be exceptional, so the stock is rising as people "get in".

2) Japan's stocks started to rise. All about the Yen etc

In both these cases I'm joining the trend, they don't dip much. So buy a little , buy a bit more iif the price is about flat or falls, so you get an average price. If the price drops you haven't lost much.

If I'm physically watching, and the price is falling, I'll still only sell if I'm going to be around to rebuy at a lower price. Experience shows it's often better to hold on, because I miss the best times to rebuy. The "Spread" is another factor, the Buy price is higher than the Sell price, always. If you sell and rebuy at the same price it'll cost you the spread which can be 1% or so if it's wide.

You could just do the buying/selling once a day, or once a week; you adjust your time frames.

These had been rising a while, but

I started last Monday 12th Aug. I'll "normalise" to a £1000 start. (

Wk#33)

2/3rd in NVD3 start of week 3000, end 4464, + 53.75%

1/3rd in 3JPN start of week 800, end 919 , + 16%

which gives £1412 , 41%.

I'm aiming to adjust this on a several-day basis, only.

I'll see how it looks Monday a.m. and probably keep the same funds for this. I expect it to be a rocky ride. Could be a disaaaaaster dahling!

For most of Passing Billions I can't act quickly. I'm using, for ISA and non Isa accounts, a "free" day- trading platform which has no "OEICS", Hargreaves Lansdown which is fairly quick to change and has a fair range of funds, a couple of banks which are less good for the range. I should combine things in to Interactive investor, Invest Engine, Fidelity, etc. (Some have higher fees but a wider range of funds. If you find something niche doing well (say Japanese electronics ) it can overwhelm any fees).

At the moment for long-term stuff I'm using a mix or Money market(5% - %25 as avilable) corporate bonds, and bringing some Tech back, with in a couple of cases Japan. Single stocks like NVIDIA , and especially leveraged ones, are often not available on fund platforms, or have silly dealing charges like £30 online, £50 by phone. OK if it's for a larger amount of course.

A guru says tech stocks will drop Tuesday - we'll see!