B'ham is unusual as it has a dedicated eye hospital. Some hospitals have a dedicated facility.eyes I think, a long time ago

Taxation. People tend to forget the introduction of VAT and it's increases.Council tax too. Wilson was keen on paying some war debt. It was not easy to move money out of the country in his era. Bit of interesting history

Cabinet Papers - The National Archives

History through the eyes of the British Cabinet. Explore the archived version of The Cabinet Papers online resource (1915-1993). For advice on searching our catalogue for the fullest range of Cabinet Papers, please read our research guide to Cabinet and its committees.

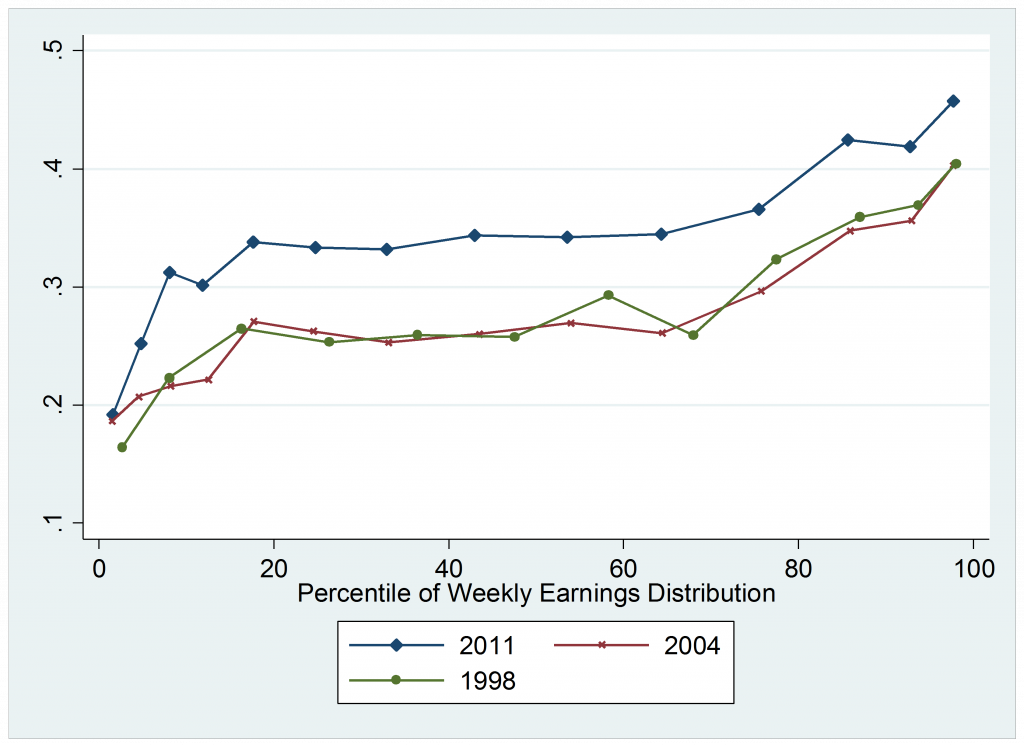

Note where the burden lies and the reasoning. You might notice Sunak is trying something similar on one aspect.

NHS. Funding in Mrs T time was well reported. Increases at around 1/2 the medical inflation rate. Under the latest lot funding again has been short. The answer now is to provide more but it doesn't make up for the over all effect of previous under funding. Rather similar in respect to the min wage.

Periods of Labour. Problem the extra money has to be obtained from some where

This has an interesting aspect. The top 1% earn more per hour and work less hours. Some interesting comments too that interest all parties including the Tory. Labour intend to have a real go at it. It's a problem area so who ever does it's a wait and see. Tax avoidance.

The top rate of income tax

If a new government were to raise the top rate of income tax, it is unlikely that the UK’s highest earners will work less hard but it is likely they will try harder to avoid paying tax. That …

blogs.lse.ac.uk

blogs.lse.ac.uk

Where does the tax burden mostly lie. No change really the median earner however the low earner end population has increased. Increase PAYE for median earners and they have less to spend which will reflect in GDP.

Some might like to look at the decline in the number hospital beds over time.